Wall Street held its breath and Silicon Valley stayed awake all night.

There is only one reason. Nvidia disclosed its latest financial report, setting three records in a row:

- Record quarterly operating revenue of $39.3 billion, up 78% from the same period last year .

- Record data center quarterly revenue of $35.6 billion, up 93% from the same period last year .

- Record full-year operating revenue of $130.5 billion, up 114% from last year .

Huang commented on this:

The demand for Blackwell is surprising because inference AI brings a new scaling law – increasing training computing power makes the model smarter, and increasing long-term thinking computing power makes the answer smarter.

Especially for DeepSeek, Huang commented in the conference call that R1 has ignited the enthusiasm of developers around the world.

This was a brilliant innovation, but more importantly, it open-sourced a world-class inference AI model that almost every AI developer is using R1.

In fact, at this point in time, the market is most concerned about two points:

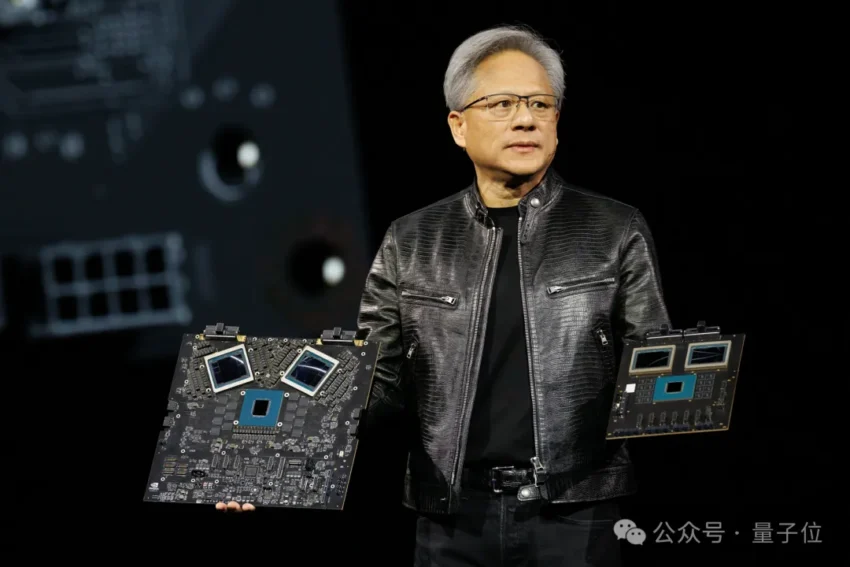

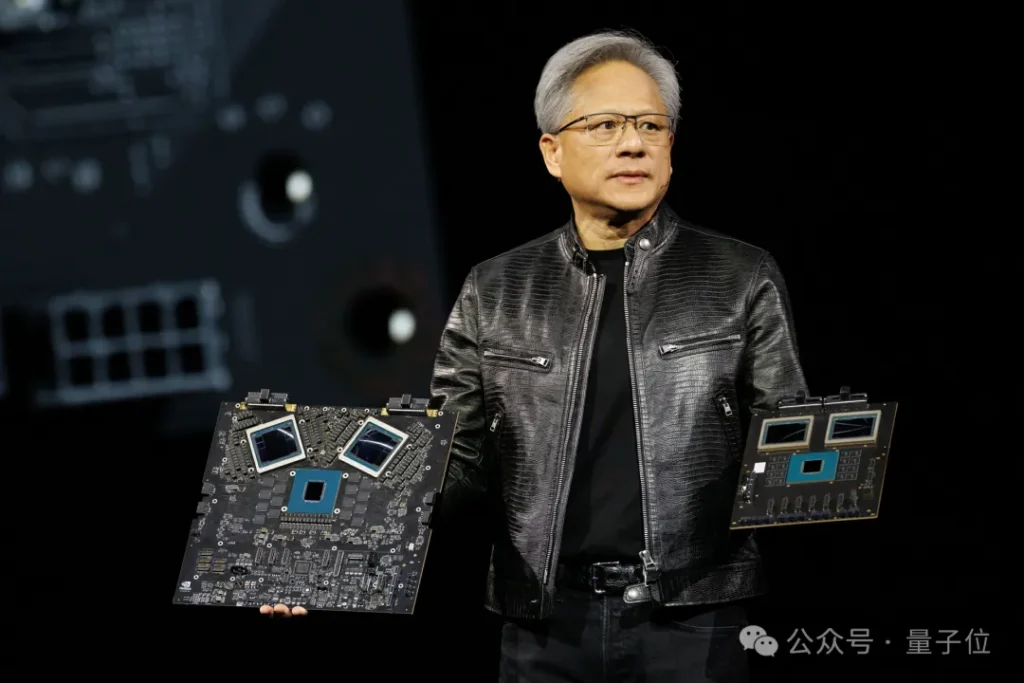

First, Nvidia’s core product in the AI market, the new generation AI chip Blackwell , was included in the financial indicators for the first time. The highly-watched issues such as capacity ramp-up and gross profit margin will be reflected in this financial report.

Second, in the face of the sudden emergence of DeepSeek , Nvidia will face investors directly and respond to how it views future trends and whether its proud moat will be broken.

Let’s find the answer from this latest financial report.

Interpretation of Nvidia’s Q4 financial report for fiscal year 2025

Like most of the quarterly results in the past three years, Nvidia’s financial report for the last quarter of fiscal 2025 still exceeded Wall Street expectations.

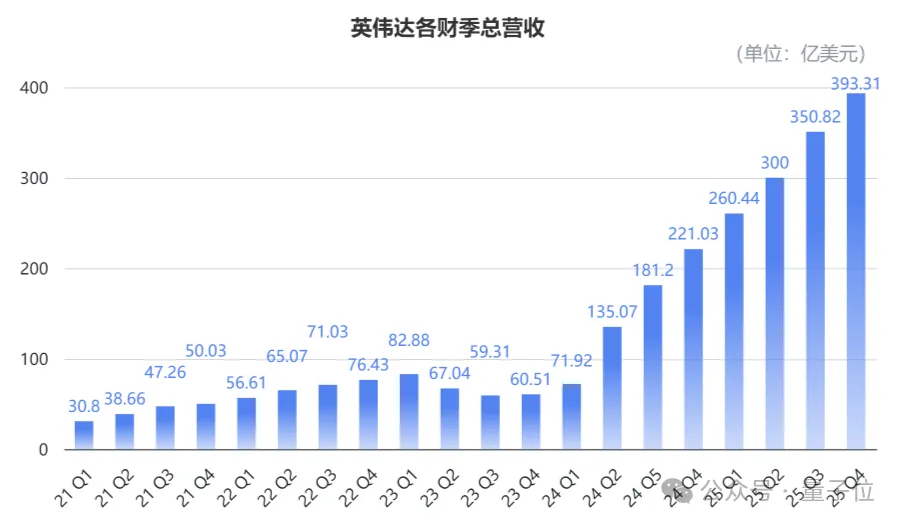

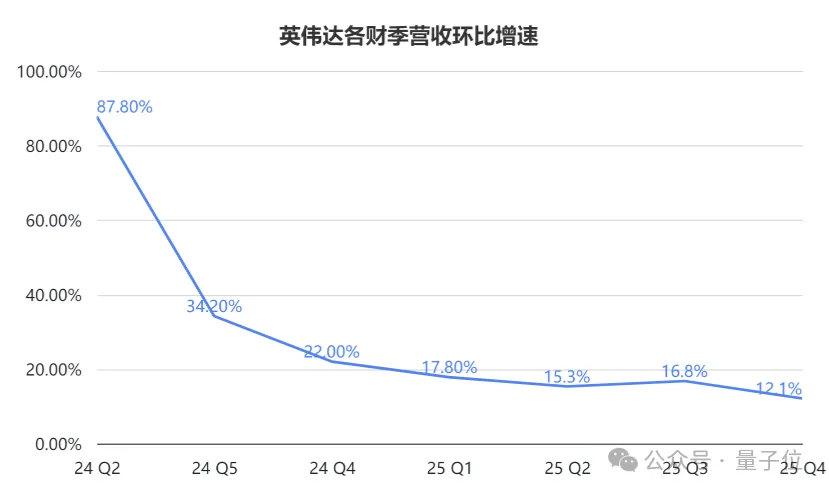

Operating revenue in the fourth quarter was US$39.3 billion (approximately RMB 285.3 billion), a year-on-year increase of 78% and a month-on-month increase of 12%, setting a record high.

Although it still exceeded analysts’ expectations of US$38.1 billion (about RMB 276.7 billion), the month-on-month revenue growth rate is further slowing down, as analysts predicted, which is also one of the reasons for the recent volatility in Nvidia’s stock price.

For the full fiscal year 2025, Nvidia’s total operating revenue was US$130.5 billion (approximately RMB 947.5 billion), a year-on-year increase of 114%.

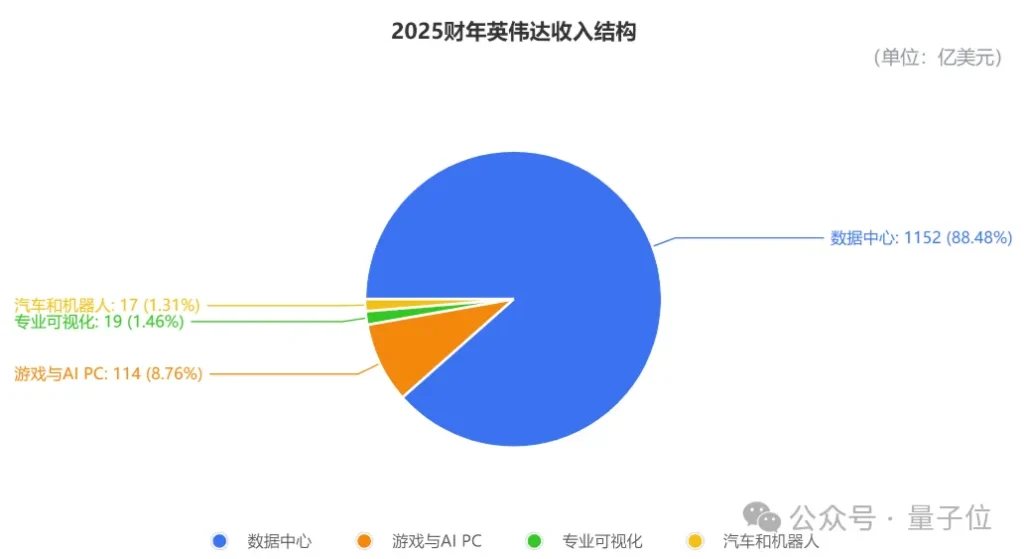

Looking at the revenue structure in detail, data centers are still the bulk of Nvidia’s revenue, with full-year revenue of US$115.2 billion (about RMB 836.4 billion), a year-on-year increase of 93%, accounting for 88% of total revenue , 10 percentage points higher than the same period last year.

Full-year revenues from gaming , professional visualization , and automotive and robotics businesses were $11.4 billion, $1.9 billion, and $1.7 billion, respectively, representing year-on-year growth of 9%, 10%, and 103%, respectively.

At the same time, NVIDIA also revealed that the Blackwell AI supercomputer has achieved large-scale production.

In the first quarter of delivery of the Blackwell architecture, sales revenue reached US$11 billion (approximately RMB 79.9 billion), making it the fastest growing product in NVIDIA’s history.

Faced with the impact of high-efficiency models such as DeepSeek-R1 on Nvidia’s chip demand, Chief Financial Officer Kress said that demand will increase 100 times:

Compared to a one-time answer, long-thinking reasoning AI may require 100 times the computing power to complete each task.

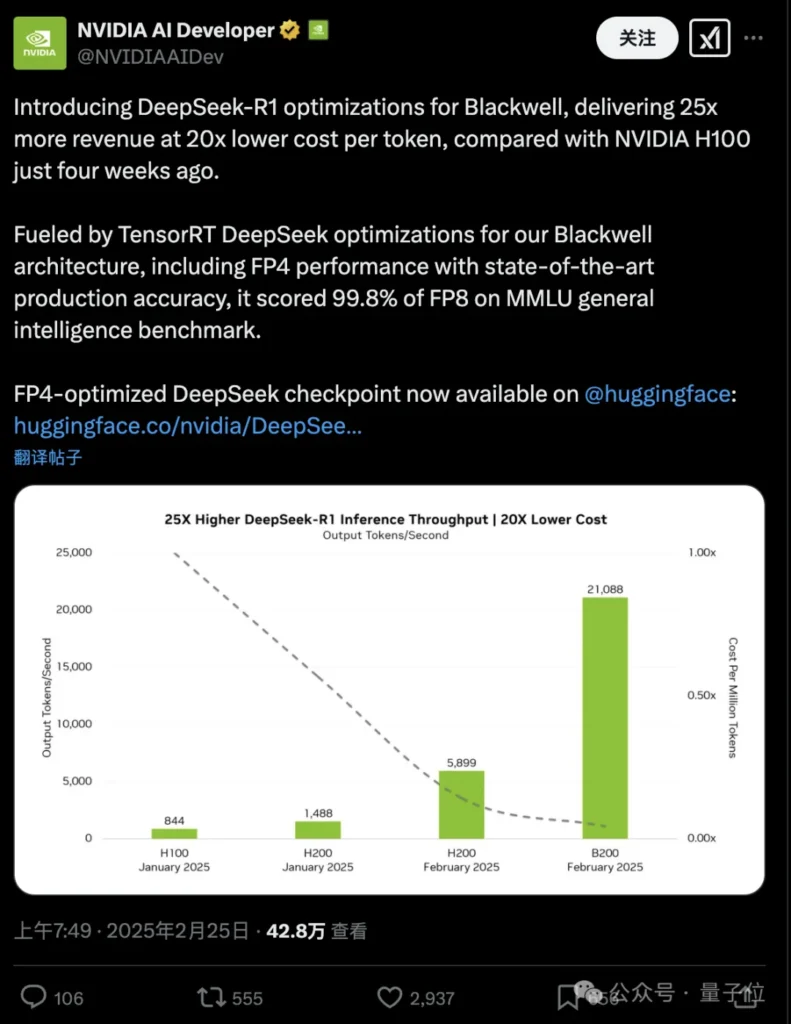

NVIDIA is also actively embracing DeepSeek, and the official release of the R1 version optimized for Blackwell reduces the cost of each token to 1/20 and increases the throughput to 25 times.

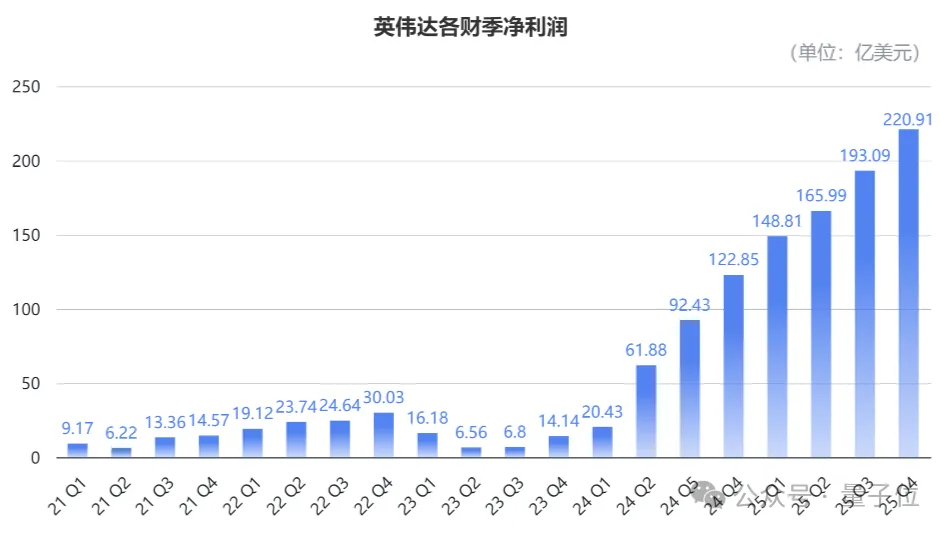

In terms of profit, the net profit in the fourth quarter was US$22.09 billion (approximately RMB 160.4 billion), an increase of 80% year-on-year and 14% month-on-month; the full-year net profit was US$72.88 billion (approximately RMB 529.1 billion), an increase of 145% year-on-year.

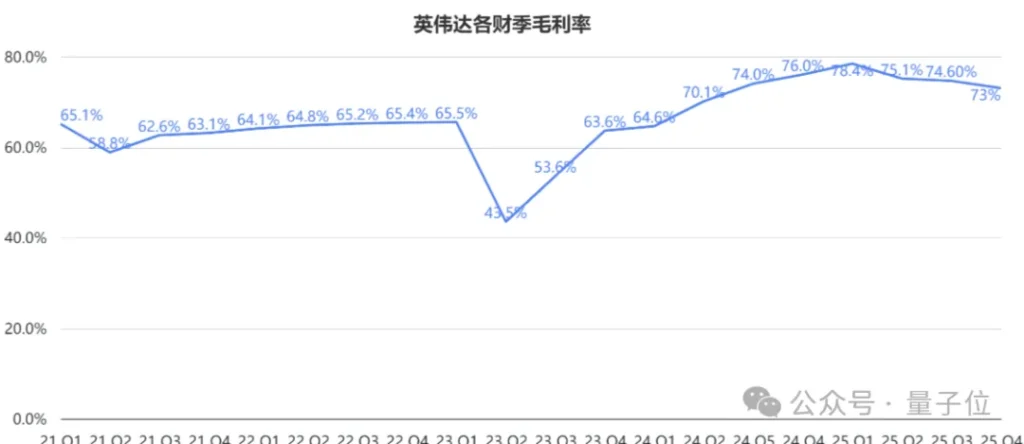

The highly anticipated gross profit margin in the fourth quarter was 73%, slightly lower than the expected 73.5%, down 3 percentage points year-on-year and 1.6 percentage points month-on-month.

The full-year gross profit margin was 75%, an increase of 2.3 percentage points year-on-year.

Against the backdrop of overall financial indicators rising and exceeding analysts’ expectations, the decline in gross profit margin in the fourth quarter was particularly eye-catching.

Nvidia explained that this was because newer data center products were more complex and more expensive.

Previously, due to the Blackwell overheating problem, the deployment of big technology data centers was delayed, and coupled with increased production costs, Nvidia made some concessions.

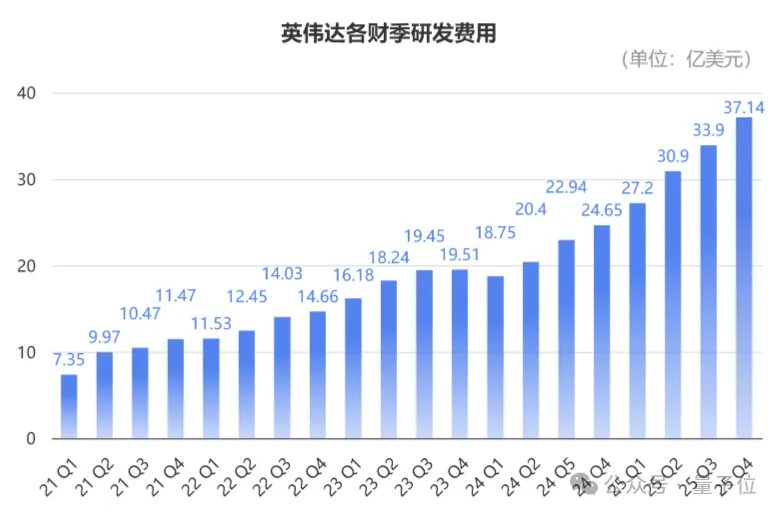

Precisely because of the obstruction in product progress, Nvidia’s enthusiasm for investment in research and development has reached an unprecedented high. In the fourth quarter, the company’s research and development expenses were US$3.714 billion (about RMB 27 billion), a year-on-year increase of 50.7% and a month-on-month increase of 9.6%.

R&D expenses in fiscal year 2025 were US$12.914 billion (approximately RMB 93.8 billion), a year-on-year increase of 48.9%.

Overall, it is still a positive and expected year-end result.

However, since DeepSeek-R1 was released in late January this year, it did not affect the indicators of this financial report.

The real impact of this “catfish” on Nvidia will depend on the performance in the first quarter of fiscal year 2026. Nvidia has given guidance:

The estimated operating revenue is US$43 billion (approximately RMB 312.2 billion), with a fluctuation of 2%.

At the same time, GAAP gross margin is expected to continue its downward trend, falling to 70.6%.

One More Thing

For NVIDIA, the computing industry, and even the entire AI industry, the next key node will be the NVIDIA GTC conference in March.

Huang’s keynote speech has been scheduled for the early morning of Wednesday, March 19, Beijing time, and three key words have been locked in advance:

Agent, robot, accelerated computing.

Compared with the keywords of the previous two years, “AI, cloud technology, metaverse/digital twins”, it focuses more on niche areas.

Financial report address:

https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-fourth-quarter-and-fiscal-2025

Author:量子位

Source:https://mp.weixin.qq.com/s/X-anuIZi5H2EByHD3wpaRQ

The copyright belongs to the author. For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.